Private Equity Advisory

Enabling extraordinary

improvements in private equity

firms' portfolio companies

Our private equity consultants work with you throughout the investment cycle. The Outsourcing Center provides private equity advisory services on sourcing, strategy, commercial due diligence, institutional investor strategy and post-acquisition value creation.

Private Equity Consulting

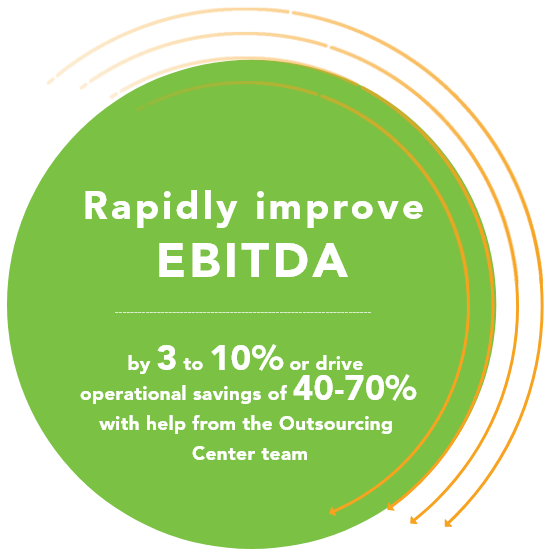

Increase revenue and dramatically improve the cost structure of portfolio companies with the Outsourcing Center’s private equity advisory services.

We understand that private equity isn’t just about the transaction. It’s also about portfolio management and fundraising.

Our private equity consultants help evaluate your target companies to include opportunities to reposition for growth strategies and streamline operations.

With our advisory services, you can reduce time spent on commercial due diligence, and hence save costs for clients. We evaluate the long-term value of your deals and offer advisory services that facilitate risk mitigation and return optimization.

Under commercial due diligence, we cover market due diligence, customer due diligence, and competition due diligence.

We help clients create new consulting and managed services organizations to serve the needs of their customers in Cybersecurity, BPO, and technology operations.

Evaluate your strategy, product/service mix, sales process, team, and messaging to enhance your company’s ability to grow in new markets or energize your current operations. Our consultants are experienced in high transaction rates as well as strategic pursuit organizations.

Improve and energize operations to support your growth and operational goals. Outsource and establish captive operations to lower costs.

We leverage IT and smart spend management practices. The Outsourcing Center covers IT strategy, PMO services, spend analytics, M&A, procurement, zero-based budgeting, zero-based spend, eCommerce, IT and business transformation, and fractional CPO & CIO services.

We evaluate your current operations to craft the right outsourcing strategy and develop and monitor the progress of outsourcing programs.

Value creation in private equity-owned companies or potential acquisitions is a careful balance of revenue growth strategies, smart cost containment, sourcing, and operations configuration.

This requires a strategic view of the possible and a well-managed implementation to achieve lower total cost and support revenue growth.

The Outsourcing Center team can help you make the right decisions and support your journey.

Seamlessly execute your exit strategies with a rigorous assessment of current business assets, mediating contract negotiations with prospective sellers and buyers, CM creation and data room setup, thorough market studies, and responses from prospective buyers.

Private Equity Advisory: Post-Acquisition

Post-acquisition, you can expect our support on returns. We do this by leading workshops that align strategic priorities with management, creating strategies for acquired companies, and guiding focused initiatives.

With our outsourcing advisory services, you’ll obtain long-term value in sustainable, transparent and actionable ways for all stakeholders.